IG Group

Japan Knock-outs

Project: Improving customer outcomes through education.

-

Knock-Outs are a CFD trade on an option. They automatically close – or get ‘knocked out’ – if the underlying market price reaches a customer’s chosen knock-out level. Think of it as a hard stop that cannot be changed or set to trail.

They move one-for-one with the underlying market – meaning that for every point the underlying moves, the price of the knock-out moves the same amount.

It is a limited risk product. By setting their own knock-out level and trade size, clients have full control over their margin and risk

Knock-outs are IGs most popularly traded product in Japan. -

In direct response to a request from the Japanese Financial Authority, my team was challenged to introduce measures aimed at enhancing the success rates of Knockout customers in the Japanese market.

Proposal:

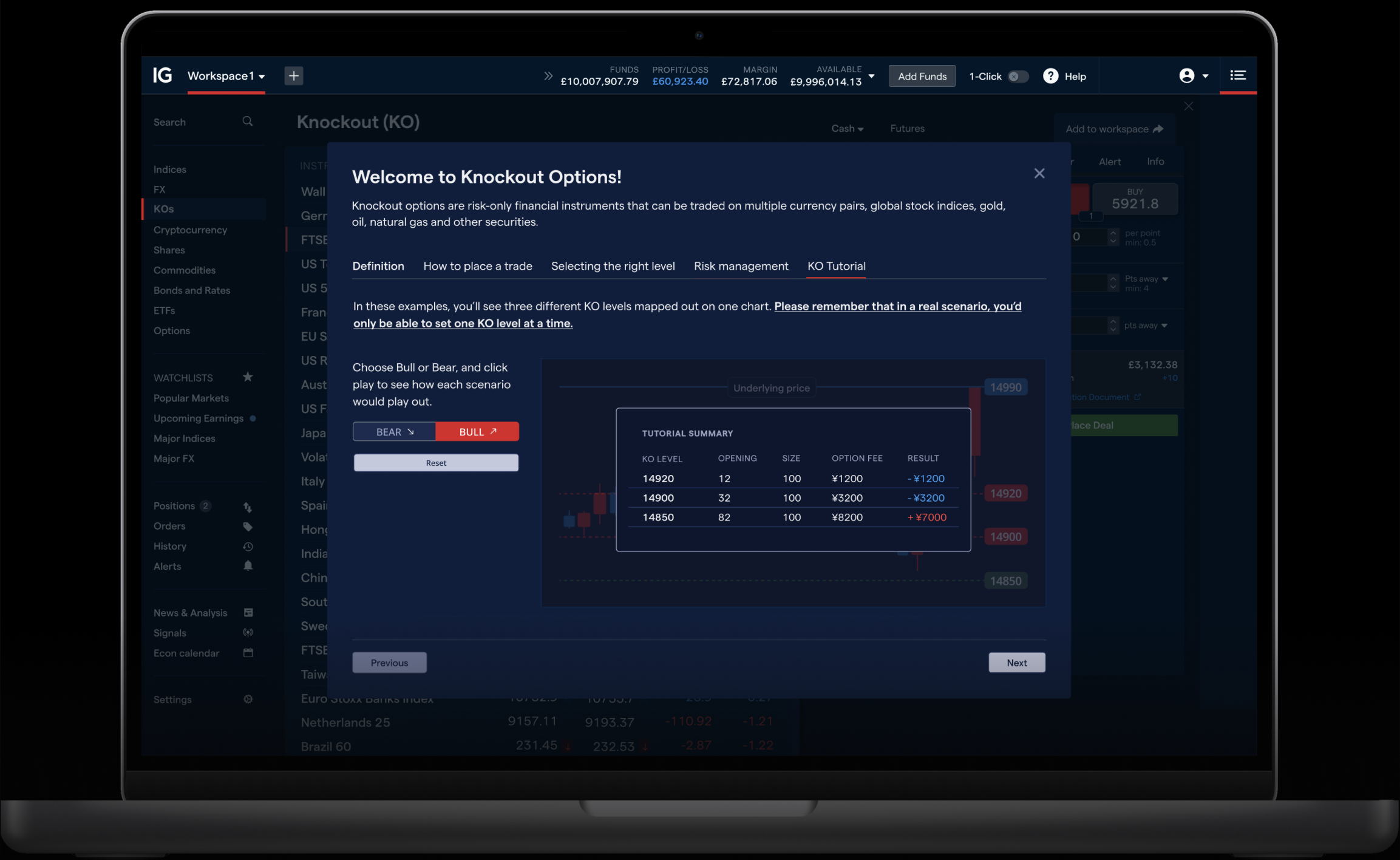

That we would introduce new education content for KO customers. We also decided to introduce a trading simulator to give clients a safe place to develop their understanding of KOs before risking real money.

Team:

Cross team initiative. I was responsible for designing the education flow and trading simulator.

Stakeholders:

CEO of IG Japan, Japan board, Compliance leads in UK and Japan offices -

Promising engagement metrics, above target

Improvement in success rates for KO traders

Gained regulator approval

Discovery and ideation

In the initial stages of the project we set about untangling objectives, surfacing user needs, delving into competitor analysis, and kickstarting early ideation. This section offers a high level glance at my approach to beginning this process.

Auditing existing designs

I kicked off the discovery for this project by looking at the existing education content for Knock-out customers. I also reviewed our internal insights library for any feedback customers had previously shared related to this trading product.

Competitor analysis and intial ideas

We ran some competitor analysis to inspire new ideas. Through doing so we recognised that interactivity was a recurring theme with Japanese education content, I wanted to explore ideas for how we might weave this into our own education flows. We ran some workshops to brainstorm ideas.

Early Ideation

During the early design phase, my team and I tossed around tons of ideas, tried out different things, and made simple designs to see what would could stick as a viable response to our challenge. As always it was about getting creative, and exploring options.

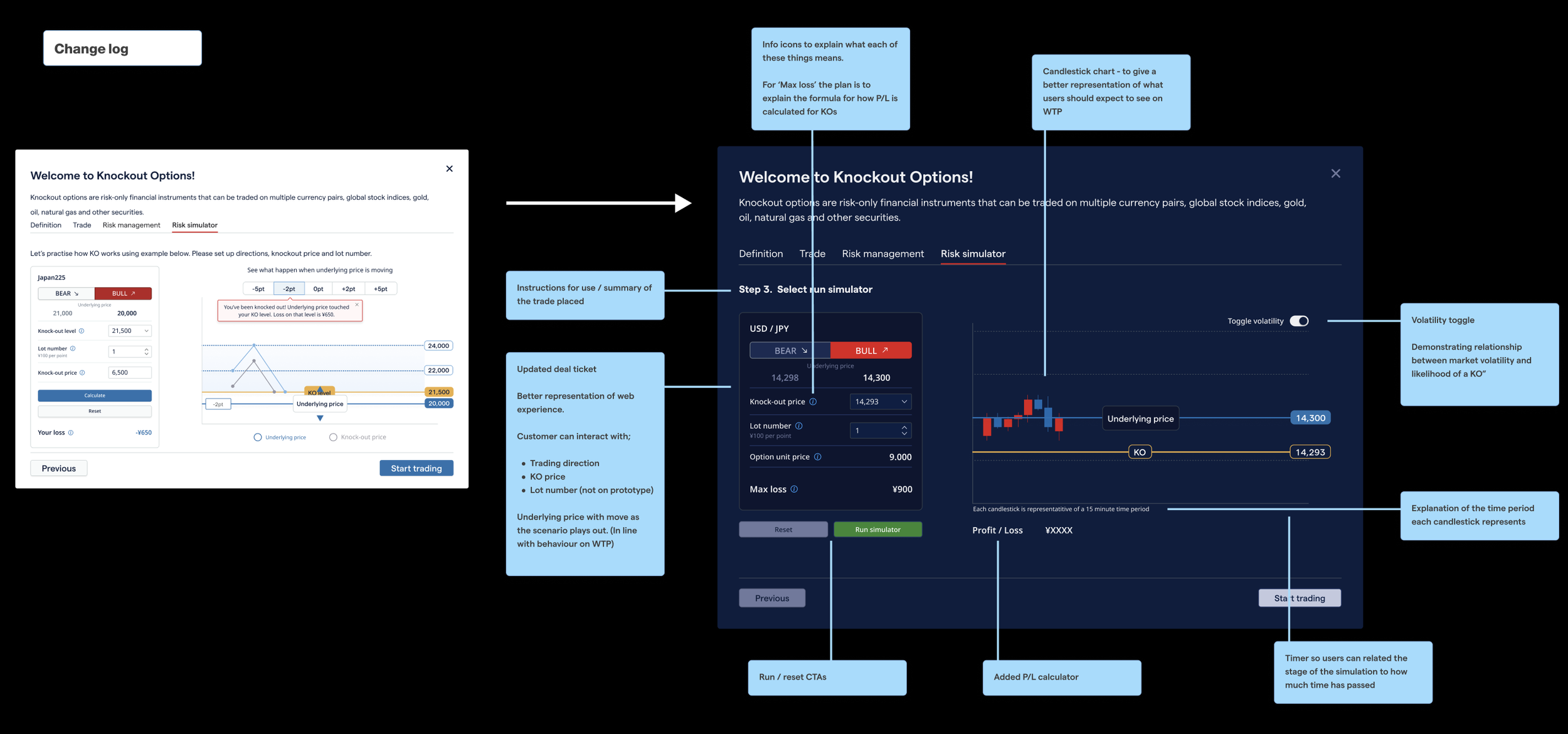

The two key focus areas identified through chatting with stakeholders were;

Market volatility, and the impact on likelihood of KO

Size of deal, and profit and loss relationship

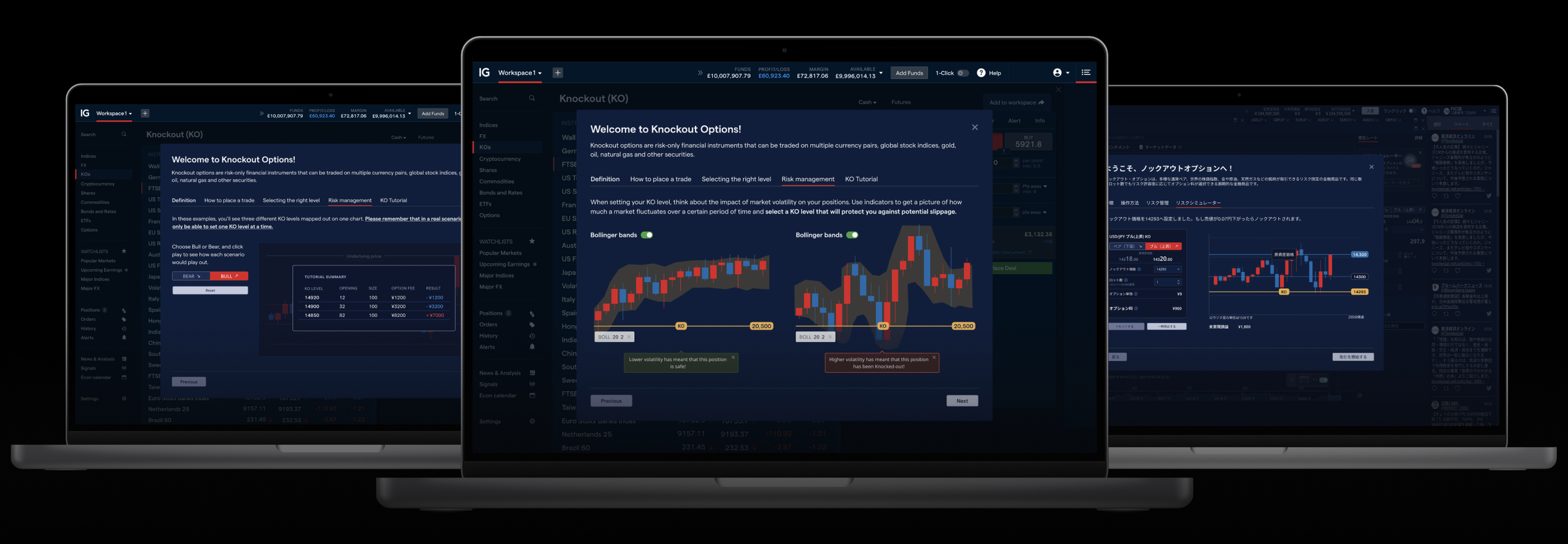

With this in mind, I made some changes to the designs ahead of our first round of usability testing with customers. Illustrated below.

Research and Testing

User research served as the foundation for decision-making. This section covers the rounds of research to date. It includes some light-touch findings gathered along the way, as well as recordings of the prototypes I set up for testing.

Internal research

Early research for this project was conducted with people within the business. We recognised that there was already a wealth of knowledge about Knock-outs and Knock-out traders that could be leveraged to support the early ideation phase for this project.

Through chatting with key stakeholders, and from analysing data that had been previously collected about KO customers, we were able to develop an understanding of why clients were losing money, and the key themes that needed to be addressed in our designs.

User research, Japan

The first round of customer testing was conducted with 10 Knock-outs customers in Japan, using our Japanese research resources. It was focussed on a prototype of the interactive Knock-outs simulator.

Key findings:

Education flow was engaging and intuitive, with 8/10 participants saying they’d find it useful

The mechanics made sense, however some participants required guidance to get from beginning to end

The core messages for the ‘KO Simulator’ (volatility, position sizing etc.) were clear and obvious to all participants.

Key challenges:

Distance from research. None of the core team was based in Japan, nor did we speak Japanese

The version of the findings that was played back to stakeholders in Japan was different from the version that was presented to product teams in the UK and Europe

Loss of research resource. Our Japanese researcher left the business shortly after testing, and took valuable knowledge with her

Below is a recording of the prototype I built for this round of testing.

User research, Singapore

For this round of research we decided to engage with customers in the Singapore market, recognising the popularity of knock-outs there, and the fact that we could research in English. Our objective was to further our understanding of how our designs were shaping up against user needs. This approach helped overcome the challenges posed by the loss of a researcher, and reinforced our commitment to customer-centric design practices.

In this round we tested new designs for the KO’s education flow, as well as two different concepts for the interactive simulator (pictured below).

Key findings

a

b

c

Detailed design

Placeholder for detailed design intro

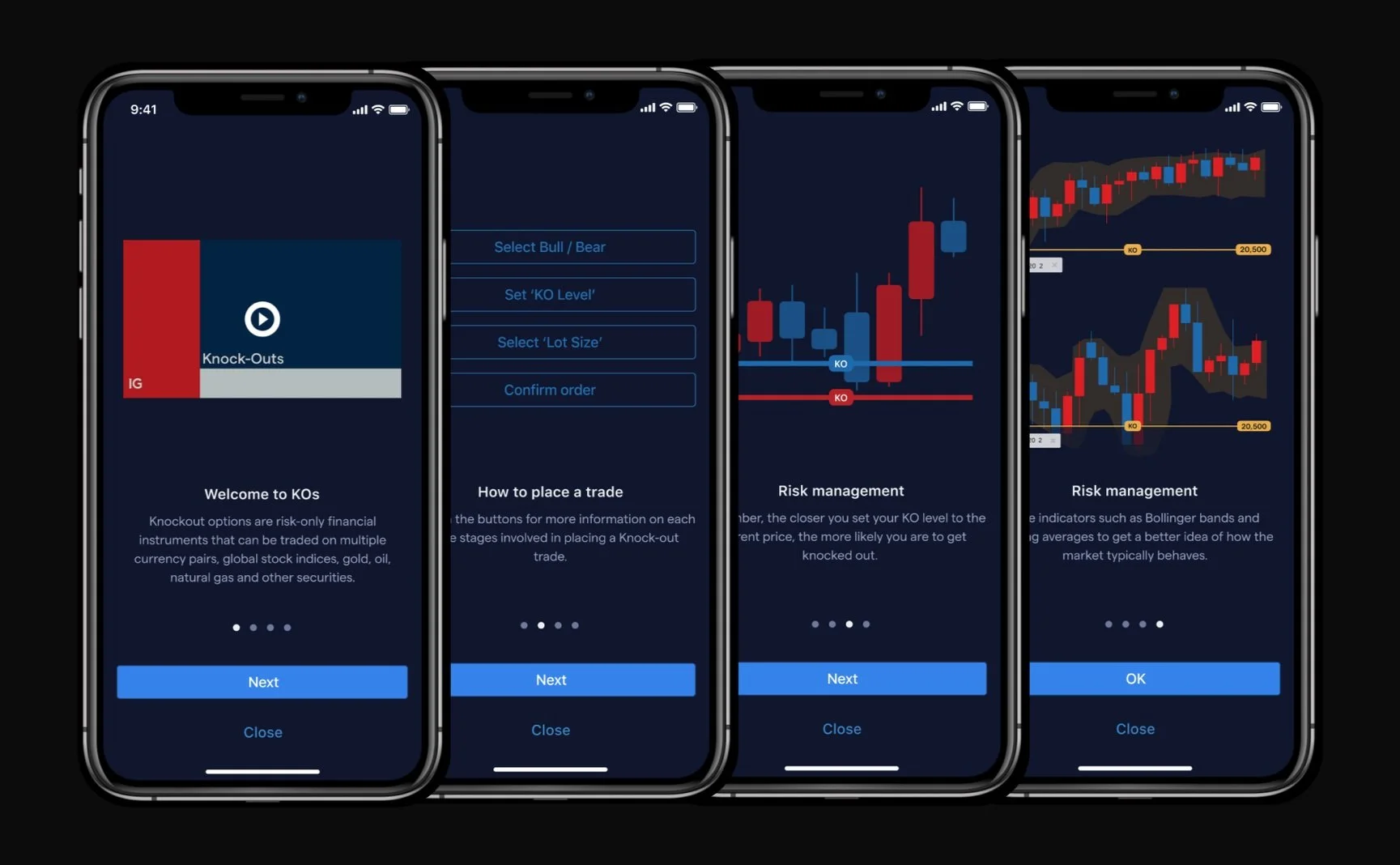

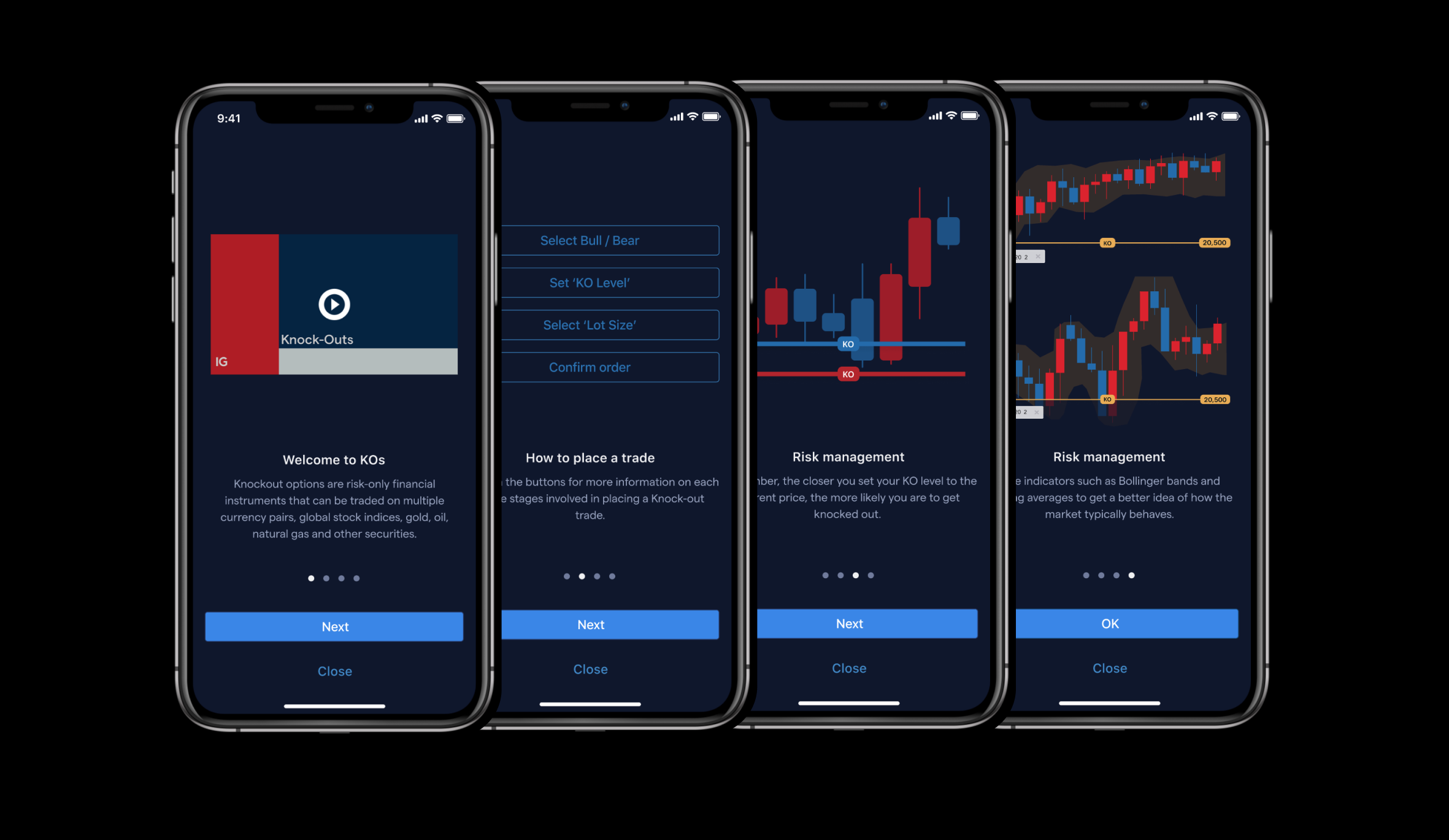

iOS and Android

Recognising the demand for a mobile version of the Knock-outs education content, we developed designs for iOS and Android users. The KO simulator was out of scope for mobile, for the time being anyway.

Key measurables

These designs have recently been developed and released for production. So far we’ve seen;

Promising engagement metrics, above target

Improvement in success rates for KO traders

Gained regulator approval